Mortgage Director

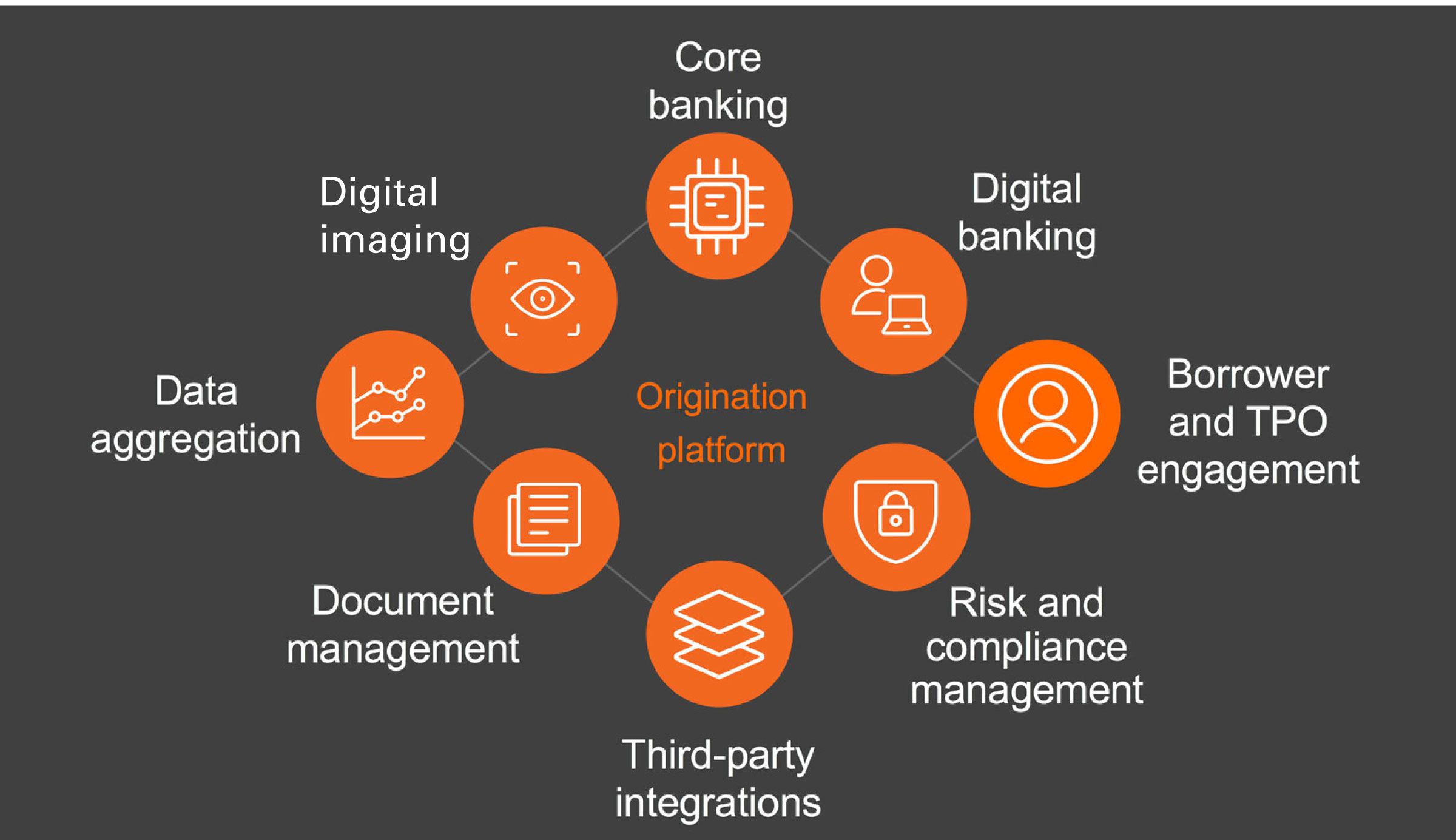

Mortgage Director is the modern loan origination system at the core of the Fiserv lending ecosystem. It streamlines lending operations and strengthens the lender's borrower relationships.

Today's lenders operate in a very competitive marketplace. It's more important than ever to leverage technology to improve service levels, streamline operations and satisfy borrowers.

All Required Functions Exist in a Single Lending Environment

By making all necessary functionality available within a single lending environment, lenders are free to chart their own path forward with the knowledge that everything they need will be accessible to them.

Mortgage Director offers everything you need to chart a course to the future of lending.

- AI and rules-based workflow

- Robust APIs and data access

- Borrower-focused, web-based experiences

- Digital compliance analysis

- Sophisticated OCR/ICR

The Benefits

Mortgage Director provides a completely digital mortgage process delivered from the center of a single mortgage lending ecosystem. The solution allows all stakeholders to collaborate on loan production offering the following benefits:

- A faster, more efficient loan origination process

- Easier connectivity to third-party providers

- System extensibility with access to internal and external tools

- Higher levels of borrower satisfaction

- Better data security

- Lower costs to close

- Automation of document classification and data extraction with OCR/ICR

- Confidence of a fully compliant system producing quality data

Get a Demo

Digital mortgage capabilities from Fiserv can help you simplify the consumer experience, offering borrowers a self-service mortgage origination option that saves the time and hassle of paper-based processes. It enables lenders to offer the kind of seamless experience consumers expect while reducing support costs and saving time on implementation.

Learn how you can streamline processes and exceed borrower expectations with a holistic view of the entire lending ecosystem. Click here to schedule your demo of Mortgage Director.

Have a question for us?

For more information on Mortgage Director and other Fiserv solutions, submit the form below.